Binary Options alternatives for traders from regulated countries where trading Binary & Digital Options is prohibited.

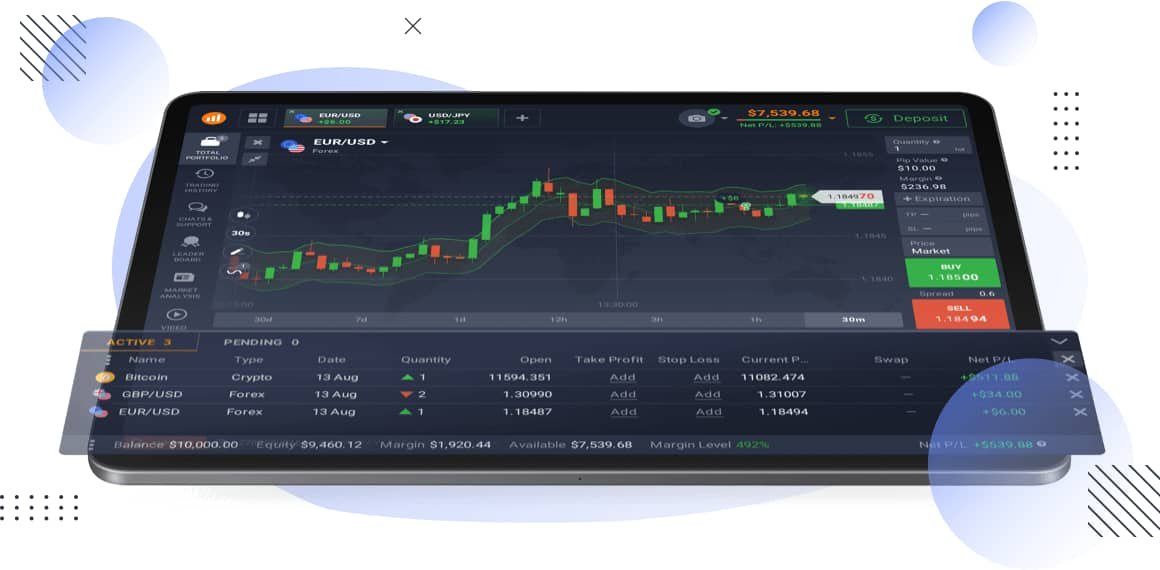

One of the alternative to IQ Option Binary Options are FXOptions. Please note that they are available only in some regulated markets. FX Options specifications may look like this (examlpe: IQ Option FX Options):

- The minimum amount required for investment is €25 or $30

- الخسائر المحتملة محدودة بمبلغ الاستثمار

- وقت انتهاء الصلاحية لمدة ساعة - احتياطي كاف لتحليل ثاقب

- القدرة على إغلاق الصفقة قبل أن تصل إلى تاريخ الاستحقاق

- ربح غير محدود للتنبؤ الصحيح حول اتجاه سعر الأصل

- قد تكون الخسائر أقل من 100٪ من الاستثمار لخيارات خارج المال (يمكن للمتداولين فتح صفقة مع وقت انتهاء لمدة ساعة وإغلاقها قبل أن تصل إلى تاريخ الاستحقاق)

تجمع خيارات الفوركس بين ميزات الخيارات العادية والفوركس. خيارات العملات الأجنبية هي النوع الوحيد من الخيارات المتاحة في أوروبا ، لذا فهي عبارة عن ملف بديل رائع للخيارات الثنائية والرقمية ل التجار المنظمين.

يرجى ملاحظة أن المتداولين من البلدان غير المنظمة لا يمكنهم الوصول إلى FXOptions. ملاحظة سريعة لـ IQ OPTION الشركات التابعة: يرجى ملاحظة أنه يمكنك الترويج IQ OPTION products only to users in Europe. If you’re working with non-regulated traffic, you can promote الخيارات الثنائية والرقمية في حين أن.

إليك ما تحتاج لمعرفته حول أداة FX Options:

كيف تقارن بأنواع الخيارات الأخرى؟

ببساطة: تمزج خيارات العملات الأجنبية بين الآليات المألوفة للخيارات والإمكانيات غير المحدودة التي يقدمها الفوركس. والنتيجة هي تداول عملة ديناميكي مع أدوات إدارة مخاطر ومخاطر غير محدودة تقريبًا.

ماذا تعني "Unlimited Upside"؟

هذا يعني أنه لا يوجد حد أقصى للعائد الذي يمكنك الحصول عليه من مركز FX Option طالما استمر السعر في التحرك في الاتجاه الذي توقعته خلال عمر الخيار.

ما هو أقصر وقت لانتهاء صلاحية خيارات الفوركس؟

1 hour. But you can sell the option ahead of time to secure a profit or manage losses.

ما هو الحد الأدنى للمبلغ المطلوب للاستثمار؟

25 يورو هو كل ما يتطلبه الأمر لبدء الاستثمار مع خيارات العملات الأجنبية.

كم عدد أزواج العملات المتوفرة؟

6 أزواج عملات مشهورة موجودة حاليًا على المنصة ، مع المزيد في المستقبل!

About IQ Option Binary Option Broker:

IQ Option has a demo account that lets traders practice trading strategies. It also gives users $10,000 in virtual funds that can be replenished at any time. It’s an excellent way to educate yourself about the different trading strategies and find out which ones suit your needs best. Then, you can start investing with real money.

What are the other broker alternatives to IQ Option Binary Options?

Top 5 Recommended Stockbrokers

When you want to invest in stocks, you’ll want to find a stockbroker who offers great services and reasonable fees. Merrill Edge is a good choice for its low trading costs, easy account opening, and strong parent company. In addition, it offers a wide selection of stocks and high-quality trading platforms. A good broker also offers fair fees, low commissions, and no inactivity or withdrawal fees. Overall quality is also important.

1. Nadex broker

Nadex offers its traders a wide range of trading options. It is a platform that provides real-time trading, including the use of binary options. These are bets on the future price of a financial asset. They also provide real-time data, which means that investors can get updates instantly as soon as an event takes place.

Nadex has a fee structure that is transparent and easy to understand. It offers low fees and trading leverage with low risk levels. Nadex brokers are recommended if you’re looking for low fees and effective leverage. They also offer low levels of risk, although capital is always at risk.

2. Oanda broker

Oanda is a good choice if you’re looking for a reliable stockbroker. They have a number of convenient features for traders, including 24/7 customer support and multilingual support. They also offer a monthly withdrawal card, which makes it easy to withdraw your funds without incurring any fees. There are also many different payment options available, depending on where you’re located.

Setting up an account with Oanda is very simple. After choosing a username and password, you will need to provide a few details, such as your employment status, your estimated income, and any legal documents you’d like to provide. In addition, you’ll need to fill out an appropriateness test to determine your level of knowledge on trading. After filling out these fields, you’ll be able to set up a trading account with the broker.

OANDA is regulated in many Tier-1 jurisdictions, and it is one of the most reputable and reliable stockbrokers. The company has been in business since 1996, and it has a proven track record. It is also well-capitalized, with capital from private equity groups. A regulated broker is more likely to be stable, which reduces counterparty risk. It also offers a wide range of tools and trading opportunities for its clients.

OANDA’s trading platform is user-friendly and efficient, with clear pricing. There are no minimum deposits for standard accounts. You can also trade on margin, but it’s important to note that trade on margin will amplify your losses.

3. 365Trading broker

365Trading has developed a trading platform that is designed to be easy for traders to navigate. This platform offers binary options on forex, stocks, indices, and commodities. It makes use of the latest financial technology to ensure reliability, security, and transparency in trades. The website is easy to navigate and comes in several languages, including Spanish, French, and English.

This broker has a reputation for fast and easy deposits and withdrawals. Its proprietary platform has been updated often based on user feedback. It offers advanced tools and a charting tool that distinguishes it from other brokers in the market. The platform allows users to switch between candlestick and line graphs.

Choosing an online stockbroker is an important decision. There are tons of options in the market and figuring out which one best fits your financial needs and preferences can be a difficult task. It’s vital that you choose a broker that offers a great trading environment. In addition, it’s important to choose one that is fully regulated and offers the best services to protect your capital and assets.

4. eToro broker

In addition to providing stock trading services, eToro offers an array of investment products. You can trade stocks and bonds, exchange crypto for fiat currencies, and invest in cryptocurrencies. Each of these products carries different risks. Some involve high risks, such as volatile markets, leverage, and limited regulatory protection. In addition, these products may not be appropriate for all investors.

eToro offers zero-commission trading with a user-friendly platform and mobile trading apps. The site also offers investments in stocks, Forex pairs, and ETFs. For those who want to invest in cryptocurrencies, eToro is one of the most popular brokers. Moreover, eToro is accessible in 140 countries.

The company also offers a wide selection of payment methods, including bank wires, credit cards, and eWallets. Traders can also choose from other deposit options, such as PayPal, Neteller, or Rapid Transfer. Withdrawal requests typically take three business days but it may wary.

In addition to providing a variety of investment tools, eToro also offers a renowned social trading community. This platform has millions users and offers the largest trading community online. However, some of its drawbacks per trading forums include high non-trading fees, limited investment options, and difficult customer support.

The platform is easy to use. It has an app for both iOS and Android-powered phones. Using the mobile app, users can check prices, check trade history, and open news on the go. The app also allows for watchlists and copy trading.

5. IC Markets broker

IC Markets offers competitive pricing and a flexible fee schedule. The spreads are relatively tight, commissions are low, and trading costs are low. IC Markets also doesn’t charge fees for inactivity or deposits. If you’re serious about trading, IC Markets is an excellent choice.

IC Markets offers customer support through multiple channels, including live chat, email, and phone. Dedicated support is available around the clock. There’s also a glossary and FAQ portal. Traders can also email IC Markets 24/7 for help with technical issues.

IC Markets offers an exceptional range of securities. Their portfolio includes many financial instruments. The company also provides a diversified array of less-common securities. Customers can even conduct trading through mobile devices.

What is IC Markets support?

IC Markets’ customer support team is knowledgeable and responsive to questions. Their representatives are available around the clock and speak a variety of languages. In addition to telephone and email support, the company offers web chat support. A comprehensive FAQ section answers frequently asked questions and is searchable.

6. XTB broker

XTB is one of the most established and respected European brokers. It offers a good range of international markets and a proprietary trading platform that has been hailed by industry watchdogs. It also offers competitive spreads and flexible account options.

XTB’s platform offers extensive research and educational materials. In addition to a free trading library, users can access a free online trading academy. This platform features technical and fundamental analysis of stocks, as well as a “Chart of the Day” series. Other features include trade alerts and news panels. The company provide its clients with comprehensive market data.

XTB free demo account

XTB also offers a free demo account for prospective customers. Furthermore, XTB has one of the best customer support services in the brokerage industry. You can contact customer service through live chat, email, or phone. Its customer support team is categorized by department to help you with any questions you may have.

The company’s trading platform features an advanced automated trading platform. Additionally, it offers negative balance protection, which is very important when dealing with CFDs. XTB also offers education through its trading academy.

كيف تتداول العقود مقابل الفروقات؟ (00:49)

كيف تتداول العقود مقابل الفروقات؟ (00:49) كيف تتداول الخيارات الثنائية *؟ (01:22)

كيف تتداول الخيارات الثنائية *؟ (01:22) فوركس. كيف تبدأ؟ (01:01)

فوركس. كيف تبدأ؟ (01:01)