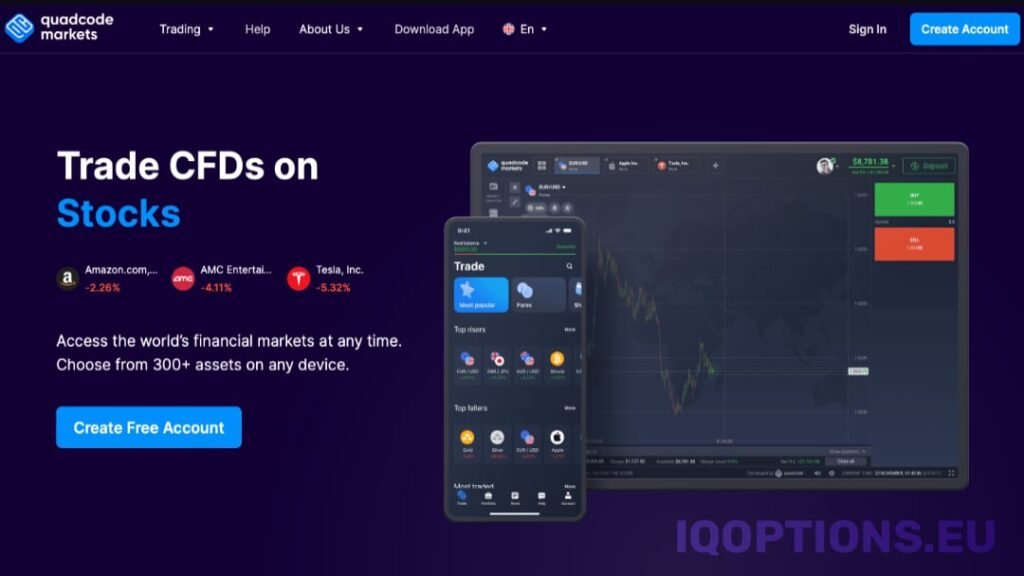

Quadcode Markets is an up-and-coming online brokerage firm that has been gaining traction in recent years. This article provides a comprehensive review of the broker, covering its features, trading platforms, account types, and more. We will also delve into the pros and cons of using Quadcode Markets, as well as share some real-life examples and statistics to help you make an informed decision.

Overview of Quadcode Markets

Quadcode Markets is a brokerage firm specializing in forex, commodities, indices, and cryptocurrencies. It offers its clients access to global markets through its advanced trading platforms and cutting-edge technology. Quadcode Markets is regulated and authorized by multiple financial authorities, ensuring a safe and secure trading environment for its clients.

Key Features of Quadcode Markets

Quadcode Markets boasts a range of features designed to cater to the needs of both beginner and experienced traders. Some of the key features include:

- Regulation: Quadcode Markets is regulated by several financial authorities, providing a secure and transparent trading environment.

- Trading Platforms: Clients have access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular and widely-used trading platforms in the industry.

- Account Types: Quadcode Markets offers multiple account types, including Standard, ECN, and VIP accounts, to cater to the varying needs of different traders.

- Education and Research: The broker provides a wealth of educational materials and market analysis tools to support traders in their decision-making process.

- Customer Support: Quadcode Markets offers 24/5 customer support through phone, email, and live chat, ensuring prompt assistance for clients.

Trading Platforms

Quadcode Markets provides its clients with access to both MT4 and MT5 trading platforms, which are renowned for their user-friendly interfaces, advanced charting tools, and extensive range of technical indicators. Some of the key features of these platforms include:

- Customizable charting tools and templates

- Automated trading through Expert Advisors (EAs)

- One-click trading functionality

- Multiple order types, including market, limit, and stop orders

- Access to a vast array of technical indicators and analysis tools

Account Types

Quadcode Markets offers three main account types to cater to the diverse needs of its clients. These include:

Standard Account

- Minimum deposit of $250

- Spreads starting from 1.5 pips

- Leverage up to 1:500

- Access to MT4 and MT5 trading platforms

ECN Account

- Minimum deposit of $500

- Raw spreads starting from 0.0 pips

- Leverage up to 1:500

- Access to MT4 and MT5 trading platforms

- Commission-based trading

VIP Account

- Minimum deposit of $10,000

- Customized tradingconditions

- Raw spreads starting from 0.0 pips

- Leverage up to 1:500

- Access to MT4 and MT5 trading platforms

- Personal account manager

- Free VPS hosting

- Exclusive webinars and events

Education and Research

Quadcode Markets is committed to helping its clients make informed trading decisions. To this end, the broker offers a wide range of educational resources and research tools, including:

- Webinars and seminars covering various trading topics

- Trading guides and video tutorials for beginners

- Advanced market analysis and insights

- Economic calendar to stay up-to-date with market events

Customer Support

Quadcode Markets prides itself on offering top-notch customer support to its clients. The broker provides 24/5 customer assistance through phone, email, and live chat. Clients can expect prompt and professional support from a team of knowledgeable representatives.

Pros and Cons

To help you make an informed decision, here are the main pros and cons of trading with Quadcode Markets:

Pros:

- Regulated by multiple financial authorities

- Access to MT4 and MT5 trading platforms

- Wide range of trading instruments

- Competitive trading conditions

- Extensive educational resources and research tools

- Responsive customer support

Cons:

- Not available to clients from certain jurisdictions

- No proprietary trading platform

- Limited deposit and withdrawal options

Conclusion

In conclusion, Quadcode Markets is a promising broker that offers a comprehensive suite of services to cater to the diverse needs of its clients. With its robust regulation, advanced trading platforms, competitive trading conditions, and extensive educational resources, Quadcode Markets is well-positioned to serve both beginner and experienced traders. However, potential clients should weigh the pros and cons carefully before deciding if Quadcode Markets is the right fit for their trading needs.

Frequently Asked Questions About Quadcode Markets Broker

In this FAQ, we’ll explore frequently asked and popular questions about Quadcode Markets Broker, a prominent brokerage firm. We’ll provide well-researched and compelling information to help you understand the company, its services, and its advantages. Let’s dive in!

Table of Contents

- What is Quadcode Markets Broker?

- What account types does Quadcode Markets Broker offer?

- Which trading platforms are available at Quadcode Markets Broker?

- How does Quadcode Markets Broker charge commissions and fees?

- Is my money safe with Quadcode Markets Broker?

- What educational resources does Quadcode Markets Broker provide?

- How reliable is Quadcode Markets Broker’s customer support?

- Summary

What is Quadcode Markets Broker?

Quadcode Markets Broker is a globally recognized brokerage firm specializing in offering online trading services to retail and institutional clients. The company provides access to a wide range of financial instruments, including forex, stocks, commodities, and indices. Quadcode Markets Broker focuses on delivering state-of-the-art trading technology, competitive pricing, and a robust suite of educational resources to its customers.

What account types does Quadcode Markets Broker offer?

Quadcode Markets Broker offers a variety of account types to cater to the diverse needs of traders. Some of the most popular account types include:

- Standard Account: This account type is perfect for new traders or those with smaller trading capital. It offers competitive spreads, flexible leverage, and no commissions.

- ECN Account: The ECN account is designed for more experienced traders, offering tighter spreads, lower latency, and a commission-based pricing structure.

- Islamic Account: This account type adheres to Sharia law by eliminating swap fees and offering interest-free trading for Muslim traders.

- Corporate Account: Quadcode Markets Broker provides tailored solutions for institutional clients, including money managers, hedge funds, and proprietary trading firms.

Which trading platforms are available at Quadcode Markets Broker?

Quadcode Markets Broker offers two leading trading platforms:

- MetaTrader 4 (MT4): Widely recognized as the industry-standard platform, MT4 provides a user-friendly interface, customizable charts, and advanced technical analysis tools.

- MetaTrader 5 (MT5): Building upon the success of its predecessor, MT5 offers additional features, such as an integrated economic calendar, more timeframes, and advanced order types.

Both platforms are available for desktop, web, and mobile devices, ensuring seamless trading experiences across various devices.

How does Quadcode Markets Broker charge commissions and fees?

Quadcode Markets Broker employs a transparent pricing structure that varies depending on the account type:

- Standard Account: This account type offers commission-free trading with competitive spreads starting from 1 pip.

- ECN Account: ECN accounts have tighter spreads, starting from 0 pips, but charge a commission per trade. The exact commission depends on the trading volume and the instrument being traded.

- Islamic Account: Like the Standard Account, Islamic accounts offer commission-free trading with competitive spreads. However, there are no swap fees associated with these accounts, making them Sharia-compliant.

- Corporate Account: Commission and fee structures for Corporate Accounts are customized based on the specific needs of the institutional client.

In addition to spreads and commissions, traders may also incur other fees, such as withdrawal fees, inactivity fees, or conversion fees for depositing and withdrawing funds in different currencies.

Is my money safe with Quadcode Markets Broker?

Quadcode Markets Broker takes the security of clients’ funds seriously by implementing the following measures:

- Segregation of Funds: Clients’ funds are held in separate bank accounts from the company’s operational funds, ensuring that clients’ money is protected in the event of any financial issues.

- Regulation: Quadcode Markets Broker is regulated by multiple jurisdictions, ensuring compliance with strict regulatory requirements and high operational standards.

- Advanced Encryption: The company employs state-of-the-art encryption technology to protect clients’ personal and financial data from unauthorized access.

- Risk Management Tools: Quadcode Markets Broker offers various risk management tools, such as stop-loss and take-profit orders, to help traders manage their risks effectively.

What educational resources does Quadcode Markets Broker provide?

Quadcode Markets Broker is committed to empowering traders through education. The company offers a comprehensive suite of educational resources, including:

- Trading Webinars: Regularly scheduled webinars covering various trading topics, led by experienced traders and market analysts.

- Video Tutorials: A library of video tutorials that cover the basics of trading, technical analysis, and platform usage.

- Market Analysis: In-depth market analysis and insights from expert analysts to help traders stay informed about the latest market trends.

- Trading Guides: Comprehensive guides and articles on various aspects of trading, from beginner to advanced levels.

How reliable is Quadcode Markets Broker’s customer support?

Quadcode Markets Broker provides exceptional customer support through various channels:

- Live Chat: Accessible 24/5, the live chat feature allows clients to receive real-time assistance from knowledgeable support agents.

- Email Support: Clients can submit queries via email, with a typical response time of 24 hours during business days.

- Telephone Support: Local phone numbers are available for several countries, allowing clients to receive support in their preferred language and at a reduced cost.

The customer support team is knowledgeable and experienced in addressing a wide range of issues, ensuring that clients receive timely and effective assistance.

Quadcode Markets Broker Affiliate Program Review

In today’s competitive financial landscape, choosing the right broker affiliate program can make all the difference. Quadcode Markets, an innovative trading platform, has recently launched a broker affiliate program that offers lucrative benefits for its affiliates. In this article, we will review the Quadcode Markets Broker Affiliate Program and provide you with valuable insights to help you make an informed decision.

As a broker affiliate, your primary responsibility is to refer new clients to Quadcode Markets. In return, you earn a commission based on the trading activity of your referred clients. The program offers several unique features and benefits that set it apart from other affiliate programs in the industry:

- Competitive commission structure

- Transparent reporting and tracking

- Marketing tools and resources

- Flexible payment options

- Personalized support

Competitive Commission Structure

Quadcode Markets offers a tiered commission structure that rewards affiliates based on the volume and quality of their referrals. The more clients you refer and the more they trade, the higher your commission. Some examples of the commission tiers are as follows:

- Up to $10 per lot for Forex and Metals

- Up to 20% of the spread for Indices and Commodities

- Up to 30% of the spread for Cryptocurrencies

Transparent Reporting and Tracking

Quadcode Markets utilizes advanced tracking technology to ensure that affiliates receive accurate and timely information about their referrals. The affiliate dashboard provides real-time data on client registrations, deposits, trading volume, and commission earnings.

Marketing Tools and Resources

To help affiliates succeed, Quadcode Markets offers a comprehensive suite of marketing tools and resources. Affiliates have access to banners, landing pages, tracking links, and promotional materials that can be customized to fit their unique marketing strategies.

Flexible Payment Options

Quadcode Markets understands the importance of cash flow for its affiliates. That’s why they offer flexible payment options, including weekly, bi-weekly, or monthly payments. Affiliates can choose from various payment methods such as wire transfer, PayPal, and Bitcoin.

Personalized Support

A dedicated account manager is assigned to each affiliate to provide personalized support and guidance. This ensures that affiliates have the resources and assistance they need to maximize their earning potential.

Case Study: A Successful Affiliate

John, a financial blogger, joined the Quadcode Markets Broker Affiliate Program and started promoting the platform to his audience. He utilized the marketing materials provided by Quadcode Markets and created engaging content around the platform’s features. Within a few months, John referred over 100 clients to Quadcode Markets, earning him a substantial commission. John’s success demonstrates the potential of the program when combined with the right marketing strategies and efforts.

Affiliate Program: Conclusion

The Quadcode Markets Broker Affiliate Program stands out in the industry with its competitive commission structure, transparent reporting, and comprehensive marketing tools. It offers a lucrative opportunity for affiliates to capitalize on their network and earn a steady income stream by referring clients to the platform. With personalized support and flexible payment options, Quadcode Markets is committed to helping its affiliates succeed. In conclusion, the Quadcode Markets Broker Affiliate Program is a top choice for individuals looking to partner with a reliable and innovative trading platform in the financial industry.

Popular Alternative Brokers to Quadcode Markets Broker

In the fast-paced world of online trading, investors are constantly seeking reliable and efficient brokers that can cater to their specific needs. While Quadcode Markets Broker has gained popularity for its advanced trading tools and user-friendly platform, there are several alternative brokers that offer unique features and services that may suit your trading requirements better. In this article, we will explore some popular alternative brokers to Quadcode Markets Broker, delving into their key offerings, advantages, and limitations.

1. Interactive Brokers

Interactive Brokers (IB) is a leading global brokerage firm known for its extensive range of trading products, low fees, and advanced trading tools. Some of the main features and benefits of Interactive Brokers include:

- Access to over 135 global markets, including stocks, options, futures, forex, and bonds

- Low trading fees and tight spreads, making it cost-effective for active traders

- Powerful trading platforms, such as Trader Workstation (TWS), which offers advanced order types, charting, and analytics

- Integration with third-party software, such as TradingView and MetaTrader, for additional tools and flexibility

Limitations of Interactive Brokers

Despite its many advantages, Interactive Brokers may not be suitable for all traders due to its complex platform and minimum account requirements. Newer traders may find the learning curve steep, and those with smaller account balances may struggle to meet the account minimums and activity fees.

2. eToro

eToro is a popular social trading platform that emphasizes simplicity and accessibility. With its unique social trading features, eToro allows users to follow and copy the trades of successful investors, making it an attractive option for novice traders. Key features of eToro include:

- Easy-to-use web-based and mobile trading platforms

- Social trading features, including the ability to copy top-performing traders

- A wide range of trading instruments, including stocks, ETFs, commodities, forex, and cryptocurrencies

- Zero-commission trading on stocks and ETFs for users from certain regions

Limitations of eToro

eToro’s limitations include relatively high fees for certain trading instruments and limited advanced trading tools. Additionally, the platform may not be available for traders in certain regions due to regulatory restrictions.

3. Charles Schwab

Charles Schwab is a well-established brokerage firm known for its excellent customer service, robust research tools, and comprehensive trading offerings. Some of the main features and benefits of Charles Schwab include:

- Access to a wide range of investment products, including stocks, options, mutual funds, ETFs, bonds, and futures

- Zero-commission trading on U.S. stocks and ETFs

- High-quality research and educational resources, such as webinars, articles, and market analysis

- Multiple trading platforms, including StreetSmart Edge and Schwab.com, cater to different trader preferences

Limitations of Charles Schwab

Charles Schwab’s main limitations include higher fees for certain services, such as options trading, and limited forex trading options. Additionally, the platform primarily caters to U.S.-based investors, which may pose limitations for international traders.

4. TD Ameritrade

TD Ameritrade is another well-regarded brokerage firm offering a diverse range of trading products, powerful trading tools, and extensive educational resources. Key features of TD Ameritrade include:

- Access to a wide variety of investment products, including stocks, options, futures, forex, ETFs, and mutual funds

- Zero-commission trading on U.S. stocks and ETFs

- Highly-rated trading platforms, such as thinkorswim, which offers advanced charting, research, and analysis tools

- Comprehensive educational resources, including webinars, video tutorials, and in-person events

Limitations of TD Ameritrade

TD Ameritrade’s limitations include higher fees for certain services, like options trading, and limited access to international markets. Moreover, the acquisition of TD Ameritrade by Charles Schwab may lead to changes in the platform’s offerings and fee structure in the future.

In conclusion, there are several alternative brokers to Quadcode Markets Broker, each with its unique features and benefits. When choosing a broker, it is essential to consider factors such as trading fees, available investment products, trading platforms, and educational resources. While Interactive Brokers, eToro, Charles Schwab, and TD Ameritrade are popular alternatives, it is crucial to assess your individual trading needs and preferences to select the most suitable broker for your requirements. No matter which broker you choose, always remember to conduct thorough research and stay informed about the latest market trends to make well-informed investment decisions.

How to trade CFD? (00:49)

How to trade CFD? (00:49) How to trade binary options*? (01:22)

How to trade binary options*? (01:22) Forex. How to start? (01:01)

Forex. How to start? (01:01)