Want to invest in real estate without buying property? REITs might be the perfect option! Learn how REITs work, the types available, and why they’re popular with global investors.

A Beginner’s Guide to Real Estate Investment Trusts

Have you ever wondered how you can invest in real estate without buying physical property? Real Estate Investment Trusts (REITs) offer a unique way to do just that! In this article, we’ll explain what REITs are, how they work, and why they could be a great addition to your investment portfolio.

What Is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. REITs pool money from many investors to purchase and manage real estate assets such as commercial buildings, apartments, shopping centers, hotels, and even data centers. By investing in REITs, individuals can gain exposure to real estate without the need to directly buy, manage, or sell properties themselves.

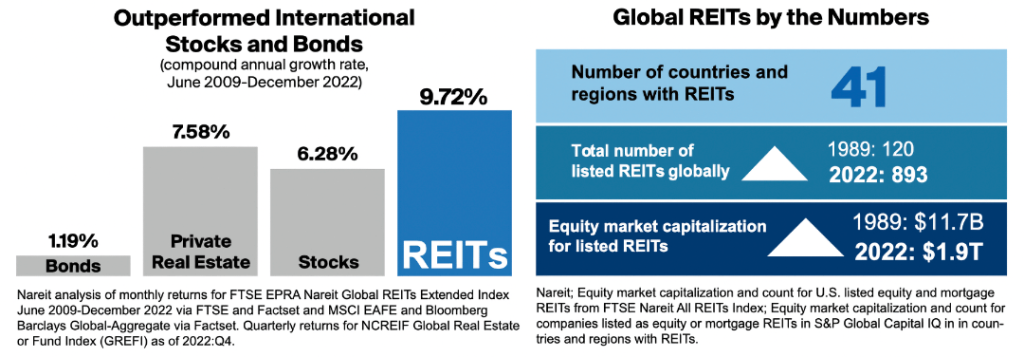

Real Estate Investment Trusts (REITs) are a specialized legal structure currently present in at least 41 countries. Initially launched in the U.S. in 1960, REITs were designed to provide individual investors with access to a diversified portfolio of income-generating real estate properties.

REITs offer notable tax advantages, making it easier for them to raise capital for real estate development. In turn, this contributes to infrastructure growth and supports broader economic development.

How Do REITs Work?

REITs operate similarly to mutual funds. Investors buy shares in the REIT, and in return, they receive a portion of the income generated from the real estate assets owned by the trust. REITs generate income primarily from renting, leasing, or selling properties, as well as from any capital appreciation of the properties themselves.

The income earned is distributed to shareholders in the form of dividends. One key advantage of REITs is that they are legally required to distribute at least 90% of their taxable income to shareholders, making them an attractive option for investors looking for steady income.

How to Invest in REITs

Investing in REITs is straightforward and can be done in a few ways:

- Publicly Traded REITs: These REITs are listed on stock exchanges like the NYSE or NASDAQ, and you can buy shares of them just like you would with any other publicly traded company.

- Non-Traded REITs: These are not listed on exchanges, making them less liquid but potentially offering less volatility.

- REIT ETFs and Mutual Funds: You can also invest in REITs through exchange-traded funds (ETFs) or mutual funds that specialize in real estate investments. This gives you diversified exposure to multiple REITs in one package.

Advantages of Investing in REITs

REITs have become popular with investors for several reasons:

- Steady Income: Since REITs are required to pay out most of their income as dividends, they can provide a steady stream of income for investors, especially those looking for passive income.

- Diversification: REITs allow investors to diversify their portfolios by adding exposure to real estate, an asset class that often moves differently from stocks and bonds.

- Liquidity: Publicly traded REITs offer liquidity, meaning you can buy or sell shares easily through the stock market, unlike direct real estate investments which can take time to sell.

- Accessibility: REITs allow small investors to get into the real estate market without needing large sums of capital. You can start investing in REITs with just the cost of a few shares.

Risks of Investing in REITs

Like any investment, REITs come with risks. It’s important to be aware of the potential downsides:

- Market Fluctuations: Publicly traded REITs can be affected by stock market volatility, even if the underlying real estate assets remain stable.

- Interest Rate Sensitivity: REITs tend to be sensitive to interest rates. When interest rates rise, REIT prices may fall as higher rates make bonds more attractive compared to dividends from REITs.

- Property-Specific Risks: The performance of a REIT may depend on the success of specific properties or sectors. For example, a retail REIT might struggle if there’s a downturn in the retail industry.

Are REITs Right for You?

REITs can be a great option for investors looking to diversify into real estate, especially those who want steady income without the hassle of directly managing properties. However, like all investments, they carry risks, so it’s important to consider your financial goals, risk tolerance, and the current market environment before investing.

Before jumping in, you might also want to explore resources like Nareit, the national association for REITs, for further insights and research on this type of investment.

REITs vs Direct Real Estate Investments: A Comparison

Real Estate Investment Trusts (REITs) provide several key advantages over traditional direct real estate investments:

- Lower Initial Investment: REITs allow you to start investing with as little as $100, which is significantly less than the typical down payment required for purchasing a physical property.

- Diversification from the Start: By investing in REITs, you gain exposure to a diversified portfolio of properties, something that would be difficult and costly to achieve with direct real estate ownership.

- No Management Hassles: REIT investors don’t have to deal with tenants, property maintenance, or other administrative burdens that come with owning physical real estate.

There are also two important structural differences between REITs and direct real estate investments that may be seen as either advantages or disadvantages, depending on your perspective:

- Leverage and Risk: REITs typically use debt to enhance their purchasing power, often with debt-to-equity ratios ranging from 50% to 150%. In contrast, individual investors in direct real estate frequently use higher levels of leverage, which can lead to larger gains but also increases risk.

- Income vs. Capital Gains: Returns from direct real estate often come from property value appreciation, with rental income being used to support the investment. REITs, on the other hand, are more sensitive to interest rates, and their returns are typically derived from the yield rather than from selling properties at a profit.

REITs vs Publicly Traded Companies and ETFs

When comparing REITs to publicly traded companies, a few notable differences stand out:

- Profit Distribution: Unlike most companies, which reinvest profits for growth, REITs are legally required to distribute the majority of their profits as dividends. This limits their ability to reinvest internally, so they often issue new shares to finance new acquisitions.

- Income Calculation and Depreciation: Net income for a REIT is calculated similarly to other companies, but it can be less meaningful due to depreciation, which reduces net income even though real estate tends to appreciate in value. As a result, REITs use a different metric—Funds From Operations (FFO)—to better reflect cash flow from their assets.

- Share Issuance: While many companies aim to keep their share count stable or even reduce it, REITs regularly issue new shares to raise capital. Although this could dilute current shareholders, it’s not necessarily a negative, as long as the new investments generate positive returns.

- Although REITs and Exchange-Traded Funds (ETFs) share some similarities—such as being pooled investment vehicles—there is one major distinction between the two: Share Structure: ETFs are open-ended, meaning the number of shares can fluctuate in response to market demand, keeping their price closely aligned with the Net Asset Value (NAV) of the underlying assets. In contrast, REITs are closed-ended, so their share price is dictated by market supply and demand, which can cause shares to trade at a premium or discount to NAV.

Future of REITS

Lower Interest Rates Boost the Appeal of REITs

The Global REIT Industry

REITs operate under specific regulations, including:

- Investing at least 75% of assets in real estate.

- Earning at least 75% of income from rent or mortgage payments.

- Generating 95% of total income from dividends and real estate-related income.

- Distributing at least 90% of net income as dividends.

- Being jointly owned by at least 100 individuals, with no more than 50% of shares held by five or fewer entities.

- Operating as a corporation, Trust, or association.

REITs typically avoid corporate taxes, with the responsibility for taxation falling on the shareholders, who pay taxes on dividend income. To learn about the specific legal requirements for REITs in different countries, it’s essential to review local legislation.

Here is booklet: https://www.pwc.com/gx/en/asset-management/assets/pdf/worldwide-reit-regimes-nov-2019.pdf

Different Types of REITs

Most REITs focus on specific types of real estate, and publicly traded REITs are generally categorized into several groups:

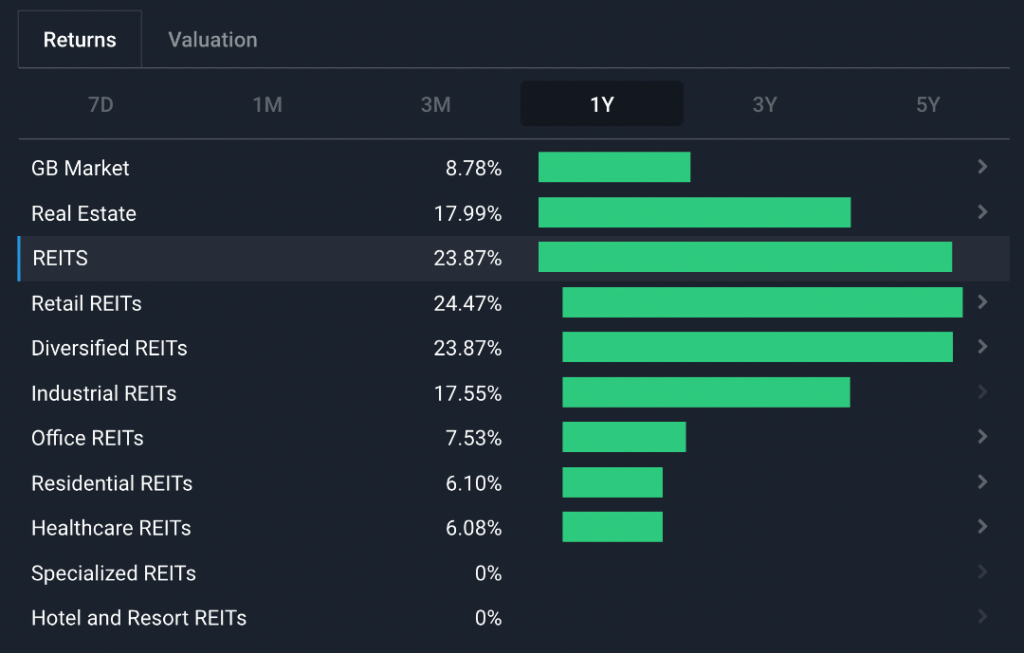

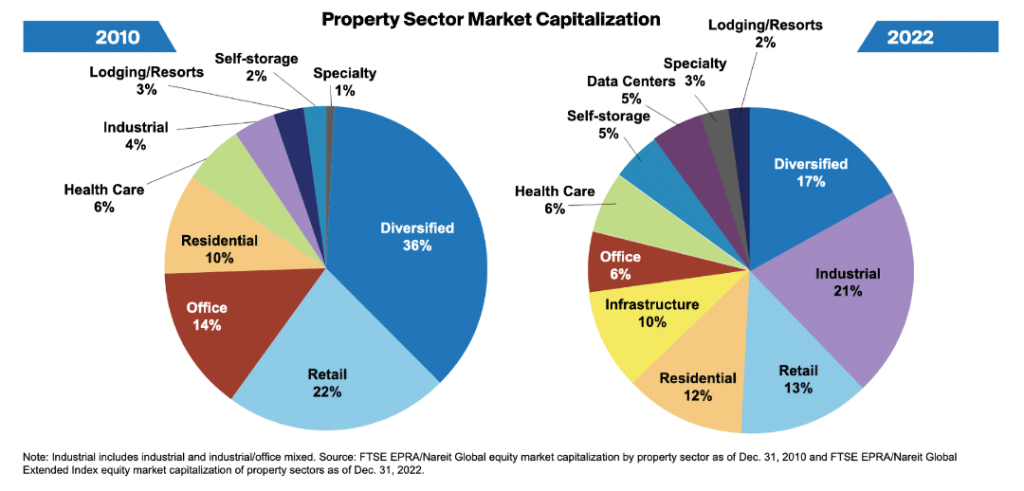

- Retail REITs: Involved in the development and operation of shopping centers and malls, retail REITs have faced challenges due to the rise of e-commerce. Despite this, they still represent a substantial part of the sector.

- Hotel and Resort REITs: These REITs own properties catering to both leisure and business travelers. Their performance is closely linked to the specific types of assets they hold.

- Residential REITs: Focused on apartment complexes, single-family homes, and student housing, residential REITs are heavily influenced by population growth and local economic conditions.

- Office REITs: Owners of commercial office buildings, these REITs are influenced by the economy of urban areas. The shift to remote work has significantly impacted this sector, but some high-quality properties continue to benefit from trends like the “Flight to Quality.” There is also potential for unused office spaces to be converted into residential units.

- Industrial REITs: These REITs primarily invest in warehouses and distribution centers. The growth of e-commerce and the scarcity of space around key transportation hubs like ports has driven up demand and rental prices. Prologis, one of the largest REITs by market value, specializes in modern distribution centers.

- Healthcare REITs: These REITs invest in hospitals, clinics, and senior living facilities. The sector has benefitted from rising healthcare expenditures, but changes in healthcare delivery models may affect some operators in the future.

- Specialized REITs: A growing category, specialized REITs target niche industries. Examples include:

- Data Center REITs: These REITs, such as Equinix and Digital Realty Trust, are gaining from the increased demand for data centers driven by AI and cloud computing.

- Self-Storage REITs: This category has become highly profitable due to low investment and operational costs.

- Telecommunication REITs: These own infrastructure like cell towers, critical for modern communications.

- Diversified REITs: These REITs own a mix of different property types, although the level of diversification can vary. In recent years, there has been a shift toward more specialized REITs that focus on particular asset classes.

Mortgage REITs

While most REITs are equity-based and own physical properties, mortgage REITs invest in mortgages and mortgage-backed securities. These REITs earn revenue from interest payments and are generally considered part of the financial sector rather than the real estate sector.

The Bigger Picture: REITs and Long-Term Trends

In the short to medium term, REITs are sensitive to interest rate changes and market sentiment. However, over the long term, performance depends on the returns generated by the underlying property portfolio.

Global economic and demographic trends significantly influence REITs. Some of the key trends include:

- Positive Drivers:

- Growing demand for data centers and telecommunications infrastructure due to advancements in AI and cloud computing.

- Increased demand for assisted living and retirement homes due to aging populations.

- Negative Drivers:

- The rise of remote work has reduced demand for traditional office spaces.

- E-commerce has lowered the demand for many retail spaces, while boosting the need for prime, high-traffic retail locations.

- Changes in healthcare delivery, such as telehealth and outpatient care, are shifting demand away from hospitals toward other types of healthcare facilities.

These shifts highlight how REITs are affected by broader changes in society, and those REITs that are aligned with growing trends stand to benefit. For example, Equinix, a data center REIT, has seen its quarterly dividend payments grow significantly over the past decade, reflecting the strong demand for its assets.

Looking Forward

Some demographic shifts are location-specific, with some cities losing residents due to high housing costs while others continue to grow. As housing shortages increase, there may be more opportunities to convert underutilized office spaces into residential units.

Conclusion

In summary, REITs are an accessible and potentially rewarding way to invest in real estate. They offer regular income, diversification, and liquidity, but they also come with risks tied to the stock market and interest rates. Whether you’re a new or experienced investor, adding REITs to your portfolio could be a smart move for long-term growth and income generation.

Further reading:

https://simplywall.st/article/lower-rates-increases-reits-appeal

How to trade CFD? (00:49)

How to trade CFD? (00:49) How to trade binary options*? (01:22)

How to trade binary options*? (01:22) Forex. How to start? (01:01)

Forex. How to start? (01:01)