Binary Options alternatives for traders from regulated countries where trading Binary & Digital Options is prohibited.

One of the alternative to IQ Option Binary Options are FXOptions. Please note that they are available only in some regulated markets. FX Options specifications may look like this (examlpe: IQ Option FX Options):

- The minimum amount required for investment is €25 or $30

- 潛在損失限於投資額

- 有效期為1小時-足夠進行深入分析

- 能夠在交易到期之前完成交易

- 無限的利潤,可以正確預測資產的價格方向

- 貨幣期權的虧損可能少於投資的100%(交易者可以在1小時的到期時間之前建立頭寸,並在到期前將其平倉)

外匯期權結合了常規期權和外彙的功能。 外匯期權 是歐洲唯一可用的選項類型,因此它們是 二進制和數字選項的絕佳替代品 為 管製商人.

請注意,來自不受管制國家的商人無權使用 FXOptions。 快速說明 IQ OPTION 聯屬會員:請注意,您可以宣傳 IQ OPTION products only to users in Europe. If you’re working with non-regulated traffic, you can promote 二進制和數字選項 代替。

這是您需要了解的關於FX Options工具的信息:

與其他類型的期權相比如何?

簡而言之:FX期權將期權的熟悉機制與外匯交易所提供的無限可能性融為一體。 結果是具有幾乎無限的上升和風險管理工具的動態貨幣交易。

“無限上漲空間”是什麼意思?

這意味著只要價格繼續沿期權生命週期內的預期方向波動,您就可以從FX期權頭寸獲得的收益沒有上限。

外匯期權最短的到期時間是什麼?

1 hour. But you can sell the option ahead of time to secure a profit or manage losses.

投資所需的最低金額是多少?

開始使用FX期權投資僅需25歐元。

有多少種貨幣對可用?

該平台上目前有6種流行的貨幣對,將來還會有更多!

About IQ Option Binary Option Broker:

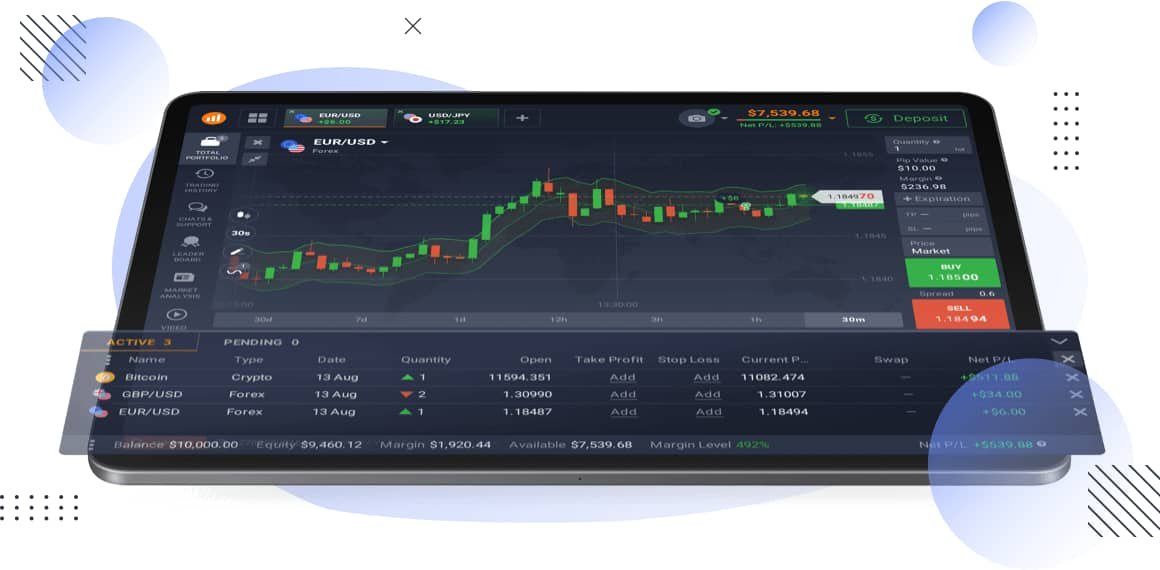

IQ Option has a demo account that lets traders practice trading strategies. It also gives users $10,000 in virtual funds that can be replenished at any time. It’s an excellent way to educate yourself about the different trading strategies and find out which ones suit your needs best. Then, you can start investing with real money.

What are the other broker alternatives to IQ Option Binary Options?

Top 5 Recommended Stockbrokers

When you want to invest in stocks, you’ll want to find a stockbroker who offers great services and reasonable fees. Merrill Edge is a good choice for its low trading costs, easy account opening, and strong parent company. In addition, it offers a wide selection of stocks and high-quality trading platforms. A good broker also offers fair fees, low commissions, and no inactivity or withdrawal fees. Overall quality is also important.

1. Nadex broker

Nadex offers its traders a wide range of trading options. It is a platform that provides real-time trading, including the use of binary options. These are bets on the future price of a financial asset. They also provide real-time data, which means that investors can get updates instantly as soon as an event takes place.

Nadex has a fee structure that is transparent and easy to understand. It offers low fees and trading leverage with low risk levels. Nadex brokers are recommended if you’re looking for low fees and effective leverage. They also offer low levels of risk, although capital is always at risk.

2. Oanda broker

Oanda is a good choice if you’re looking for a reliable stockbroker. They have a number of convenient features for traders, including 24/7 customer support and multilingual support. They also offer a monthly withdrawal card, which makes it easy to withdraw your funds without incurring any fees. There are also many different payment options available, depending on where you’re located.

Setting up an account with Oanda is very simple. After choosing a username and password, you will need to provide a few details, such as your employment status, your estimated income, and any legal documents you’d like to provide. In addition, you’ll need to fill out an appropriateness test to determine your level of knowledge on trading. After filling out these fields, you’ll be able to set up a trading account with the broker.

OANDA is regulated in many Tier-1 jurisdictions, and it is one of the most reputable and reliable stockbrokers. The company has been in business since 1996, and it has a proven track record. It is also well-capitalized, with capital from private equity groups. A regulated broker is more likely to be stable, which reduces counterparty risk. It also offers a wide range of tools and trading opportunities for its clients.

OANDA’s trading platform is user-friendly and efficient, with clear pricing. There are no minimum deposits for standard accounts. You can also trade on margin, but it’s important to note that trade on margin will amplify your losses.

3. 365Trading broker

365Trading has developed a trading platform that is designed to be easy for traders to navigate. This platform offers binary options on forex, stocks, indices, and commodities. It makes use of the latest financial technology to ensure reliability, security, and transparency in trades. The website is easy to navigate and comes in several languages, including Spanish, French, and English.

This broker has a reputation for fast and easy deposits and withdrawals. Its proprietary platform has been updated often based on user feedback. It offers advanced tools and a charting tool that distinguishes it from other brokers in the market. The platform allows users to switch between candlestick and line graphs.

Choosing an online stockbroker is an important decision. There are tons of options in the market and figuring out which one best fits your financial needs and preferences can be a difficult task. It’s vital that you choose a broker that offers a great trading environment. In addition, it’s important to choose one that is fully regulated and offers the best services to protect your capital and assets.

4. eToro broker

In addition to providing stock trading services, eToro offers an array of investment products. You can trade stocks and bonds, exchange crypto for fiat currencies, and invest in cryptocurrencies. Each of these products carries different risks. Some involve high risks, such as volatile markets, leverage, and limited regulatory protection. In addition, these products may not be appropriate for all investors.

eToro offers zero-commission trading with a user-friendly platform and mobile trading apps. The site also offers investments in stocks, Forex pairs, and ETFs. For those who want to invest in cryptocurrencies, eToro is one of the most popular brokers. Moreover, eToro is accessible in 140 countries.

The company also offers a wide selection of payment methods, including bank wires, credit cards, and eWallets. Traders can also choose from other deposit options, such as PayPal, Neteller, or Rapid Transfer. Withdrawal requests typically take three business days but it may wary.

In addition to providing a variety of investment tools, eToro also offers a renowned social trading community. This platform has millions users and offers the largest trading community online. However, some of its drawbacks per trading forums include high non-trading fees, limited investment options, and difficult customer support.

The platform is easy to use. It has an app for both iOS and Android-powered phones. Using the mobile app, users can check prices, check trade history, and open news on the go. The app also allows for watchlists and copy trading.

5. IC Markets broker

IC Markets offers competitive pricing and a flexible fee schedule. The spreads are relatively tight, commissions are low, and trading costs are low. IC Markets also doesn’t charge fees for inactivity or deposits. If you’re serious about trading, IC Markets is an excellent choice.

IC Markets offers customer support through multiple channels, including live chat, email, and phone. Dedicated support is available around the clock. There’s also a glossary and FAQ portal. Traders can also email IC Markets 24/7 for help with technical issues.

IC Markets offers an exceptional range of securities. Their portfolio includes many financial instruments. The company also provides a diversified array of less-common securities. Customers can even conduct trading through mobile devices.

What is IC Markets support?

IC Markets’ customer support team is knowledgeable and responsive to questions. Their representatives are available around the clock and speak a variety of languages. In addition to telephone and email support, the company offers web chat support. A comprehensive FAQ section answers frequently asked questions and is searchable.

6. XTB broker

XTB is one of the most established and respected European brokers. It offers a good range of international markets and a proprietary trading platform that has been hailed by industry watchdogs. It also offers competitive spreads and flexible account options.

XTB’s platform offers extensive research and educational materials. In addition to a free trading library, users can access a free online trading academy. This platform features technical and fundamental analysis of stocks, as well as a “Chart of the Day” series. Other features include trade alerts and news panels. The company provide its clients with comprehensive market data.

XTB free demo account

XTB also offers a free demo account for prospective customers. Furthermore, XTB has one of the best customer support services in the brokerage industry. You can contact customer service through live chat, email, or phone. Its customer support team is categorized by department to help you with any questions you may have.

The company’s trading platform features an advanced automated trading platform. Additionally, it offers negative balance protection, which is very important when dealing with CFDs. XTB also offers education through its trading academy.

如何交易差價合約? (00:49)

如何交易差價合約? (00:49) 如何交易二元期權*? (01:22)

如何交易二元期權*? (01:22) 外匯交易。 如何開始? (01:01)

外匯交易。 如何開始? (01:01)